Do you want to know how access to trade finance can increase your cross-border imports and exports? Explore our Trade Finance hub for practical tools.

Are you a treasury or operations manager looking to mitigate the risks and efficiently manage your business’ cash flow? If so, check out our Treasury Management hub.

Whether you want updates from infrastructure support to cross-border transactions or clearing house operations to processing techniques, you can find all on our Payments hub.

Ready to to increase your imports / exports to guarantee the payment and delivery of goods? Find out more about LCs here.

Whether you’re transporting goods, or learning about supply chains, warehousing, transportation and packaging, we’ve got you covered.

Need to know which International Commerce Term is right for your needs? Explore our curated guides from shipping expert Bob Ronai.

Prioritising sustainable supply chains? Building inclusive trade? Working towards the UN’s 2030 SDGs? Read the latest on global sustainable standards vs green-washing here.

Heading into international markets? From the correct documentation to standardisation, here’s what you need to know for a streamlined customs clearance process.

TradeTech is rapidly evolving to help reduce some of the biggest challenges when it comes to trade. Keep up with these innovations here.

The issues feature experts across the industry on the latest developments with specific themed and regional editions.

Insights by the industry, for the industry. These include thought leadership pieces, interview write ups and Q&As.

Working closely with industry experts and trade practitioners we provide inclusive educational guides to improve your technical knowledge and expertise in global trade.

We undertake qualitative and quantitative research across various verticals in trade, as well as create reports with industry association partners to provide in-depth analysis.

Subscribe to our market-leading updates on trade, treasury & payments. Join the TFG community of 160k+ monthly readers for unrivalled access in your inbox.

Welcome to Trade Finance Talks! On our series we hear from global experts in trade, treasury & payments.

Experience the true nature of the TFG community through panel discussions on the latest developments - engage with questions.

Join us as we interview leaders in international trade, treasury, payments and more! Watch and learn.

We partner with industry conferences around the world to ensure that you don’t miss out on any event; in person or online, add to your calendar now.

Get involved in our most important campaign of the year, celebrating the achievements of women in our industry and promoting gender equity and equality.

Our excellence awards in trade, treasury, and payments are like no other. You can't sponsor them, and they're independently judged. They are the most sought-after industry accolades.

Trade finance is a tool that can be used to unlock capital from a company’s existing stock, receivables, or purchase orders. Explore our hub for more.

A common form of business finance where funds are advanced against unpaid invoices prior to customer payment

Also known as SCF, this is a cash flow solution which helps businesses free up working capital trapped in global supply chains.

A payment instrument where the issuing bank guarantees payment to the seller on behalf of the buyer, provided the seller meets the specified terms and conditions.

The release of working capital from stock, through lenders purchasing stock from a seller on behalf of the buyer.

Due to increased sales, a soft commodity trader required a receivables purchase facility for one of their large customers - purchased from Africa and sold to the US.

Purchasing commodities from Africa, the US, and Europe and selling to Europe, a metals trader required a receivables finance facility for a book of their receivables/customers.

An energy group, selling mainly into Europe, desired a receivables purchase facility to discount names, where they had increased sales and concentration.

Rather than waiting 90 days until payment was made, the company wanted to pay suppliers on the day that the title to goods transferred to them, meaning it could expand its range of suppliers and receive supplier discounts.

Mark heads up the trade finance offering at TFG where his team focuses on bringing in alternative structured finance to international trading companies.

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Download our our free Letters of Credit guide

Welcome to TFG’s Letters of Credit hub. Find out how we can help you access Letters of Credit to increase your imports and exports to guarantee the payment and delivery of goods. Or, discover the latest research, information and insights on Letters of Credit here.

Letters of credit (also know as documentary credits) are payment instruments that constitute a definite undertaking of the issuer (“the issuing bank”) on the instruction of the buyer (“applicant”) to pay a certain specified amount to a seller (“the beneficiary”) at sight or on a future determinable date (“the maturity date”) provided that documents stipulated in the letter of credit/documentary credit are presented in compliance with the stated terms and conditions.

The issuing bank issues the documentary credit on behalf of its customer (“the applicant”) or on its own behalf.

These undertakings are known as “documentary credits”, as they specify the documents that must be presented in order for the credit to be honoured.

These are also known as “letters of credit” (LCs) as they were originally issued in a physical document form addressed to the beneficiary with the issuing bank’s undertaking to pay upon receipt of complying documents.

There are several critical features of documentary credits/letters of credit:

The purpose of a documentary credit is to provide a mechanism or arrangement to facilitate the settlement of an international or domestic trade transaction by use of a bank undertaking.

It should be noted that banks only deal with documents and not with goods, services or performance to which the documents may relate.

The terms and conditions of a documentary credit form the basis upon which the applicant must reimburse an issuing bank when a complying presentation is made.

Documentary credits assure the beneficiary of payment as long as they present the requisite complying documents to the nominated bank, the confirming bank (if any), or the issuing bank.

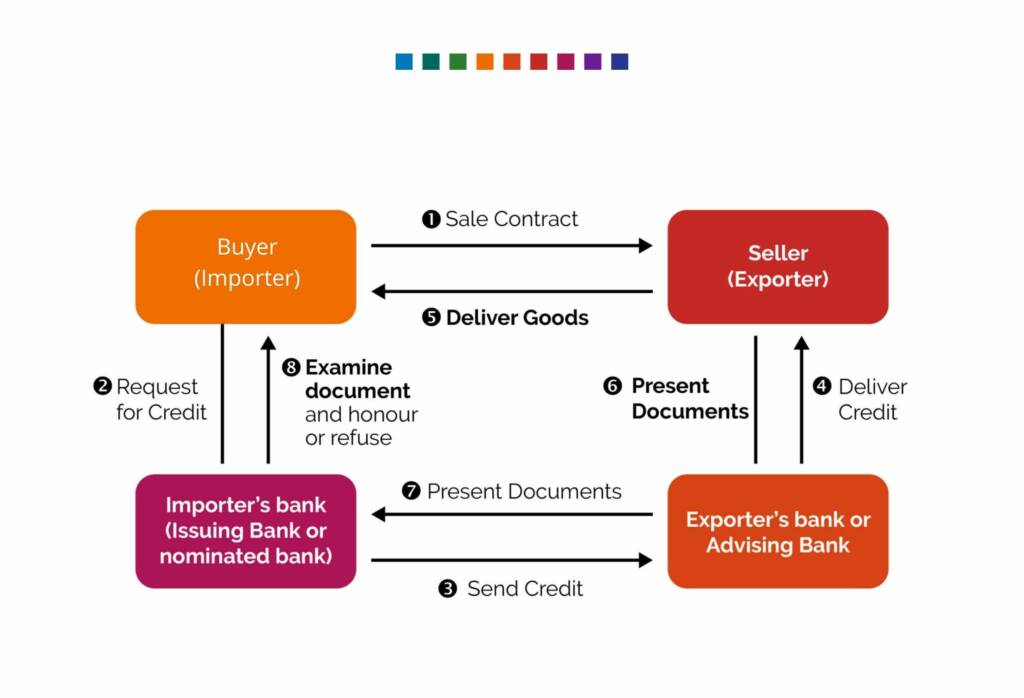

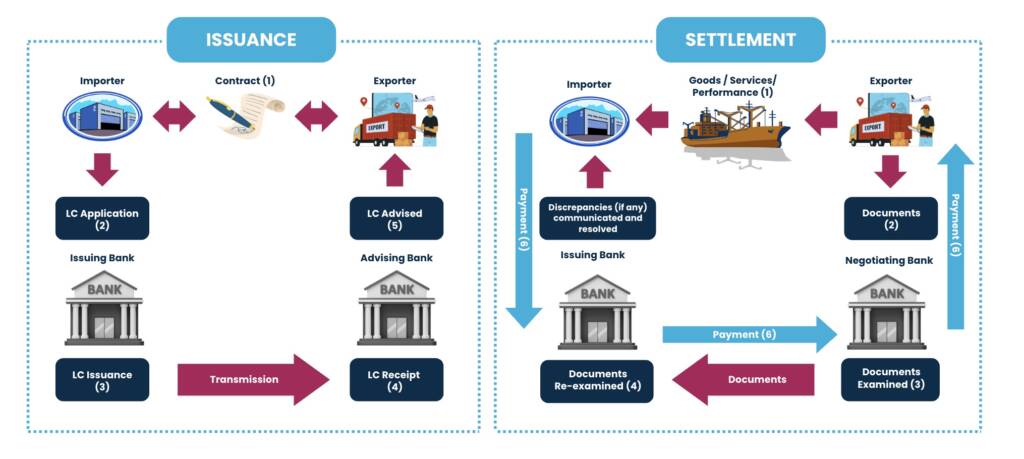

The normal LC process flow can be diagrammatically represented as follows:

The TFG team works with the key decision-makers at 270+ banks, funds and alternative lenders globally, assisting companies in accessing Letters of Credit.

Our international team are here to help you scale up to take advantage of trade opportunities. We have a team of sector specialists, from fuel experts to automotive gurus.

Often the financing solution that is required can be complicated, and our job is to help you find the appropriate trade finance solutions for your business.

Read more about Trade Finance Global here, and how we can help you with your Letter of Credit queries.

Look no further. We’ve put together our feature Letters of Credit insights, research and articles, and you can catch the latest thought leadership from the TFG, listen to podcasts and digest the latest news from the LC community right here.

Letters of Credit are issued and formatted under the guidelines of the Uniform Customs & Practice for Documentary Credits, or the UCP600, that is issued by the International Chamber of Commerce (ICC). Using one is fairly straightforward, both for businesses selling and those buying goods and services.

One of the parties, usually the importer, will contact a bank to serve as an intermediary and to guarantee to the seller that the goods will be paid for according to the agreement. All parties involved need to agree to the terms and sign the contract. This lowers the risk of doing business significantly, as Letters of Credit are legally binding documents that are acknowledged by 175 countries worldwide.

Although the guidelines and the form of any LC are largely the same, the content is not. It is crucial that both the buyer and the seller inspect the documents carefully and check for errors and mistakes that may end up in delays, further costs, or deferred payment. Even a minor oversight can be quite costly in this regard, and it is advisable to use several sets of eyes to check the documents.

Letter of Credit terms include:

Letters of Credit are useful to any business that trades in large volumes, both domestically, and cross-border. They are important to ensure the cash flow of a company and lowers the risk of default due to non-payment from the end customer.

Additionally, a LC can benefit companies that structure their business around e-Commerce or services.

When deciding whether or not to request a LC, some considerations might include:

International traders or wholesale producers of goods are the primary users of LC. These types of company need to be certain that they will not suffer losses from selling to overseas buyers that they are unfamiliar with.

In the unfortunate case that the recipient of the goods is unwilling or unable to pay the seller, the LC is activated, and under the terms of the agreement, the bank will be obliged to cover the missing payment. After the intermediary completes the payment, the bank will deal with the buyer according to the domestic law of the country where the buyer is located.

Online, e-commerce and service businesses often use LC for overseas contracts. For companies producing software, or other online services that demand the employment of significant resource, it is important to consider external finance to free up working capital.

Small or Medium Enterprises (SMEs) account for 99% of businesses. Letters of Credit can help alleviate some of the cash flow constraints stemming from delayed and long payment terms from end customers. Large international companies are often culprits for late payments to SMEs, which can often put small companies at financial strain, or even out of business.

Risk and trust are one of the major challenges when it comes to trade, be that domestic or international. The specificity and legal weight of LC are a big advantage, given that they are accepted and acknowledged by 175 countries, reduce the risk of doing business overseas, and provide transparent collaboration between unknown parties.

Finally, Letters of Credit provide better clarity on the transaction, as all of the goods or services supplied would be defined in detail. This provides additional comfort to the buyer as well as removing the possibility that the descriptions of the goods ordered are vastly different from what arrives.

Using Letters of Credit can significantly advantage your business, regardless if you are a seller or buyer of goods and services. This trading tool is legally binding in almost all countries of the world, providing better transparency and creating trust in your business.

Using an LC, you can do business with any company or business around the world while being certain that all goods agreed upon will be received and that all payments will be fulfilled.

For any company, this secured access to the global market means lower prices and better services in a wider market. Additionally, it means that you can safely offer your goods and services to any buyer around the world, with little risk that the products you have provided will not be paid for.

Using Letters of Credit can significantly advantage your business, regardless if you are a seller or buyer of goods and services. This trading tool is legally binding in almost all countries of the world, providing better transparency and creating trust in your business.

Using an LC, you can do business with any company or business around the world while being certain that all goods agreed upon will be received and that all payments will be fulfilled.

For any company, this secured access to the global market means lower prices and better services in a wider market. Additionally, it means that you can safely offer your goods and services to any buyer around the world, with little risk that the products you have provided will not be paid for.

There are different types of LCs depending on the kind of business or transaction that it is needed. In most cases, these secondary features are used to increase security and make the operation easier, faster, and more transparent.

While there is a definite time and place of each type of LC, business should be aware that certain additions and clauses stipulated might increase the bank’s fee, or add some features that can cause future problems for one of the parties involved.

An Irrevocable Letter of Credit allows the buyer to cancel or amend the LC, provided that other parties agree. This can be used to trade additional goods that were not a part of the original LC inside the same shipment or to allow the exporter of products extra time to fulfil their obligation.

A Confirmed Letter of Credit is used to further ensure the seller by adding more security. This addition stipulates that if the issuing bank from the buyer doesn’t pay the requested amount of money, the seller’s bank guarantees payment.

This article can be added if there is reduced trust in the buyer, or if the money requested is crucial to stable financial liquidity of the seller.

Most LCs will include this clause in the agreement, especially in international trade between partners that haven’t done business in the past.

A Transferable Letter of Credit is commonly used when there are intermediaries involved in the transaction, or when there are more than two parties included in the LC. In this case, the LC can be transferred to other entities, provided that the original beneficiary agrees.

This type is usually employed by the seller’s bank, especially when the seller is an SME, as a way to reduce the risk of the transaction to the bank, usually decreasing the price of the trade in the process.

This article of the LC stipulates that all payments will be fulfilled as soon as there is documentation that the goods or services have been received by the buyer. This payment can be made by the buyer, or by the buyer’s issuing bank, giving the buyer some additional time to fulfil the debt.

Contrary to this type of LC, there is the Standby Letter of Credit that doesn’t have this clause, and that needs to be activated in the case that the buyer can’t fulfil the payment.

A deferred or usance LC is used to allow deferred payment from the buyer for a specified time period. This slightly reduces the risk of unintentional non-payment and lowers the cost of an LC. Additionally, a Deferred Letter of Credit is more enticing for the buyer, making it more likely for them to accept buying goods or services.

A Red Clause Letter of Credit obligates the buyer’s issuing bank to provide partial payment to the seller prior to shipping products or providing the service. It is usually used to secure a certain supplier and to expedite the shipping process, but it often makes the LC significantly more expensive.

Find out more about the different types of LC in the next page of our LC guide, here.

There are several situations where a business is either unable to get access to a letter of credit, perhaps due to a low credit score, or, because the supplier or customer does not want to use an LC to finance the transaction. Given that open account trade cover 80% of cross-border trade, businesses with good commercial relationships often won’t use LCs. Alternatives to LCs are often used to finance small purchases, perhaps those under $100k, given that they are significantly cheaper and faster to set up.

In cases where a business has a good trading history, as well as paying its vendors and suppliers in time, revolving vendor accounts can be used to extend payment terms. Using these tools, a business can order supplies, materials, and services in advance on credit. Once all the necessary materials are ordered, a business can forward them to end users or customers, paying the supplier before the credit is due.

This type of account can be problematic however, as the seller may refuse to ship goods and services to a business that hasn’t paid their previous charge. Finally, some sellers will reject to enter this agreement, especially if abroad, as the entire risk of debt collection falls on the seller.

In this case, a third party, either a commercial bank or another entity can finance the advances or outstanding payables on any goods and services paid, assuming the risk of the sale contract not being fulfilled. This type of financing is usually made for a relatively short time period and it is not as uniform as a Letter of Credit.

Due to the fact that all risk is on the third party, this type of credit is usually more expensive and not applicable to sales of common goods. Read our PO finance guide here.

This alternative to LC assumes that a third party, usually a commercial bank, will advance the seller for up to 80% of the total charge, assuming the risk of the customer or buyer paying the invoice in total once the goods arrive. Once the invoice is paid, the bank’s fee is withheld, and the rest of the funds are transferred to the seller’s account.

This tool is very useful to companies that suffer from diminished liquidity, but as the bank is taking more risk than when using a Letter of Credit, it is significantly more expensive than an LC. Trade Finance Global have put together a more extensive invoice factoring guide, which can be found here.

The main disadvantage of using an LC compared to other methods is the relative cost of insurance, that may increase the overall cost of doing business. Letters of Credit should be used primarily on large shipments that may influence the liquidity and cash flow of the company, as well as when doing business with international buyers and sellers.

Additionally, an LC creates an issue for sellers, as the payment will be based on the documentation, and not the actual goods or services provided. Sellers need to be certain that the goods mentioned in the agreement are exactly as they are, with every minute detail included.

Finally, the disadvantage for the buyer is that the payment is connected to the documentation and not the actual provision of goods and services. Buyers need to ensure that all received products are exactly per specifications and have no flaws or damages before they create the necessary documentation that proves that they have received the goods.

A red clause letter of credit is a variation of the traditional LC that contains a unique clause allowing the bank to make advance payments to the exporter before the exporter presents any shipping documents.

Similar to a red clause LC, a green clause LC is a variation on the traditional LC that allows a nominating bank to make an advance payment to the exporter. Experts often consider green clause LCs to be an extension of red clause LCs.

The key differences between red and green clause letters of credit are:

1) Advance percentage:

– With a red clause LC, the percentage of the total letter value available for an advance is generally around 20 – 25%.

– In contrast, with a green letter of credit, the percentage is far greater, often closer to 75 – 80% of the total value of the letter.

2) Security:

– Importers have much more security if using a green clause LC because of the stringent documentation requirements. If importing goods, the buyer is technically providing the advance against the documentation of title.

– Using a red clause LC, the buyer can take an advance before the producer has even made the goods.

Find out more about red clause and green clause letters of credit here.

Key Standards

The ICC Uniform Customs and Practice for Documentary Credits (UCP 600) establishes the global standards for the utilisation of letters of credit in international trade. Additionally, the Swift network, particularly its Category 7—Documentary Credits standards, serves as the primary technical framework for handling LC, making Swift the central infrastructure for exchanging LCs and related messages. Typically, MT700 message is sent by the issuing bank to the advising bank to indicate the terms and conditions of a documentary credit which has been originated by the sender (issuing bank).

Legal Framework

LCs are subject to the ICC Uniform Customs & Practice for Documentary Credits (UCP 600). The legal requirements for using a LC can vary depending on the jurisdiction and the specific terms and conditions of the LC.

Sourced from ICC DSI

Letters of Credit are issued and formatted under the guidelines of the Uniform Customs & Practice for Documentary Credits, or the UCP600, that is issued by the International Chamber of Commerce (ICC). Using one is fairly straightforward, both for businesses selling and those buying goods and services.

One of the parties, usually the importer, will contact a bank to serve as an intermediary and to guarantee to the seller that the goods will be paid for according to the agreement. All parties involved need to agree to the terms and sign the contract. This lowers the risk of doing business significantly, as Letters of Credit are legally binding documents that are acknowledged by 175 countries worldwide.

Although the guidelines and the form of any LC are largely the same, the content is not. It is crucial that both the buyer and the seller inspect the documents carefully and check for errors and mistakes that may end up in delays, further costs, or deferred payment. Even a minor oversight can be quite costly in this regard, and it is advisable to use several sets of eyes to check the documents.

Letter of Credit terms include: